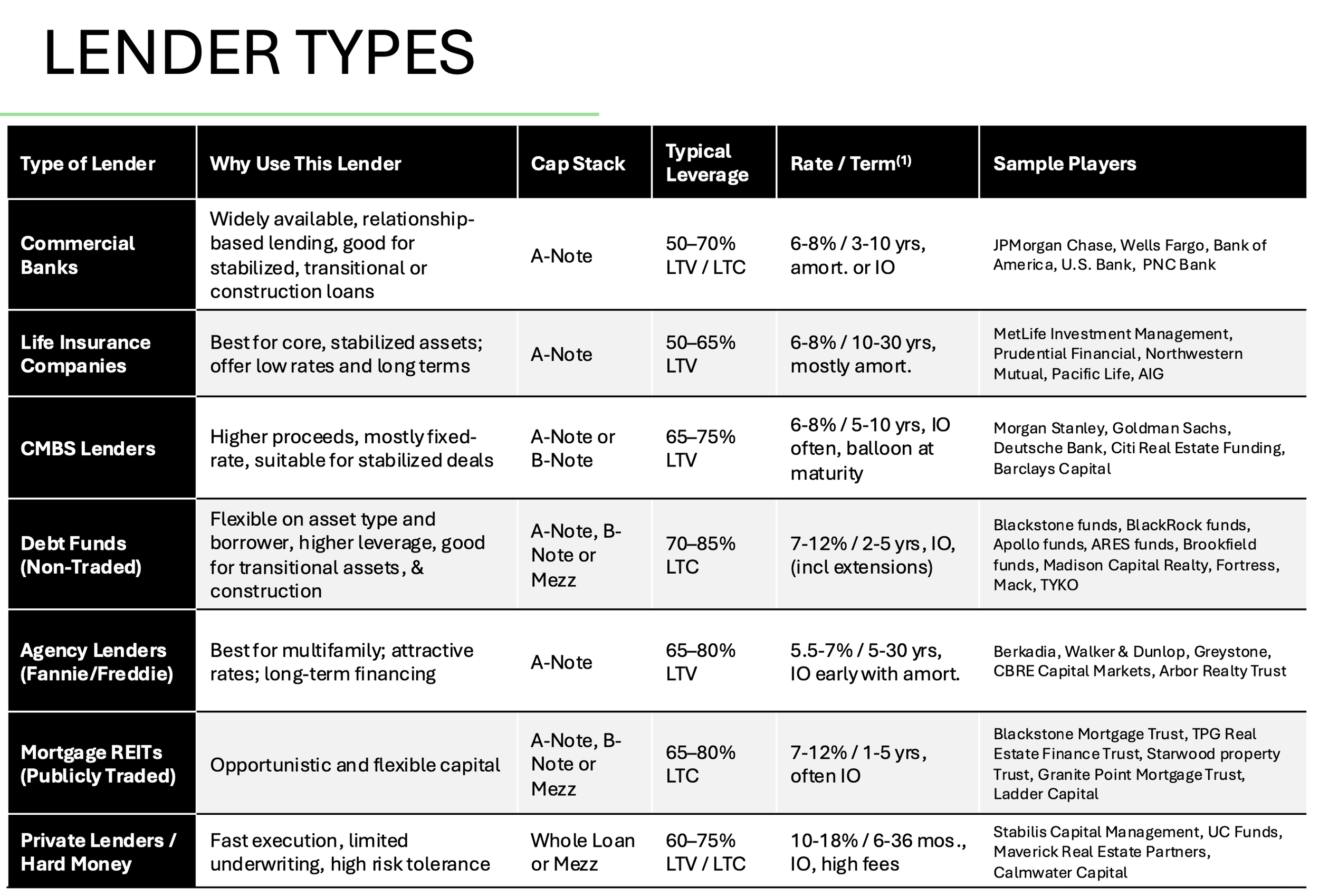

Real Estate Lenders: A Quick Guide

In commercial real estate, the type of lender you choose can significantly shape your financing terms and overall deal structure. Here's a breakdown of the main lender categories, what they're best for, and how they typically operate:

1. Commercial Banks

Best For: Stabilized, transitional, or construction loans.

Leverage: 50–70% LTV/LTC

Terms: 6–8% interest for 3–10 years; amortizing or interest-only (IO)

Notable Players: JPMorgan Chase, Wells Fargo, Bank of America

2. Life Insurance Companies

Best For: Core, stabilized assets needing low rates and long durations.

Leverage: 50–65% LTV

Terms: 6–8% for 10–30 years; mostly amortizing

Notable Players: MetLife, Prudential, Northwestern Mutual

3. CMBS Lenders (Commercial Mortgage-Backed Securities)

Best For: Stabilized deals seeking higher, fixed-rate proceeds.

Leverage: 65–75% LTV

Terms: 6–8% for 5–10 years; often IO with balloon payments

Notable Players: Morgan Stanley, Goldman Sachs, Deutsche Bank

4. Debt Funds (Non-Traded)

Best For: Transitional assets and construction; high leverage and flexibility.

Leverage: 70–85% LTC

Terms: 7–12% for 2–5 years; IO, extensions common

Notable Players: Blackstone, Apollo, Brookfield, Fortress

5. Agency Lenders (Fannie Mae / Freddie Mac)

Best For: Multifamily projects needing low-cost, long-term financing.

Leverage: 65–80% LTV

Terms: 5.5–7% for 5–30 years; IO early, then amortizing

Notable Players: Berkadia, CBRE Capital Markets, Greystone

6. Mortgage REITs (Publicly Traded)

Best For: Opportunistic plays needing flexible capital.

Leverage: 65–80% LTC

Terms: 7–12% for 1–5 years; often IO

Notable Players: Starwood, Ladder Capital, TPG Real Estate Finance

7. Private Lenders / Hard Money

Best For: Speedy execution and high-risk tolerance.

Leverage: 60–75% LTV/LTC

Terms: 10–18% for 6–36 months; IO with high fees

Notable Players: Stabilis Capital, UC Funds, Calmwater Capital

(1) estimated as of 4.7.25