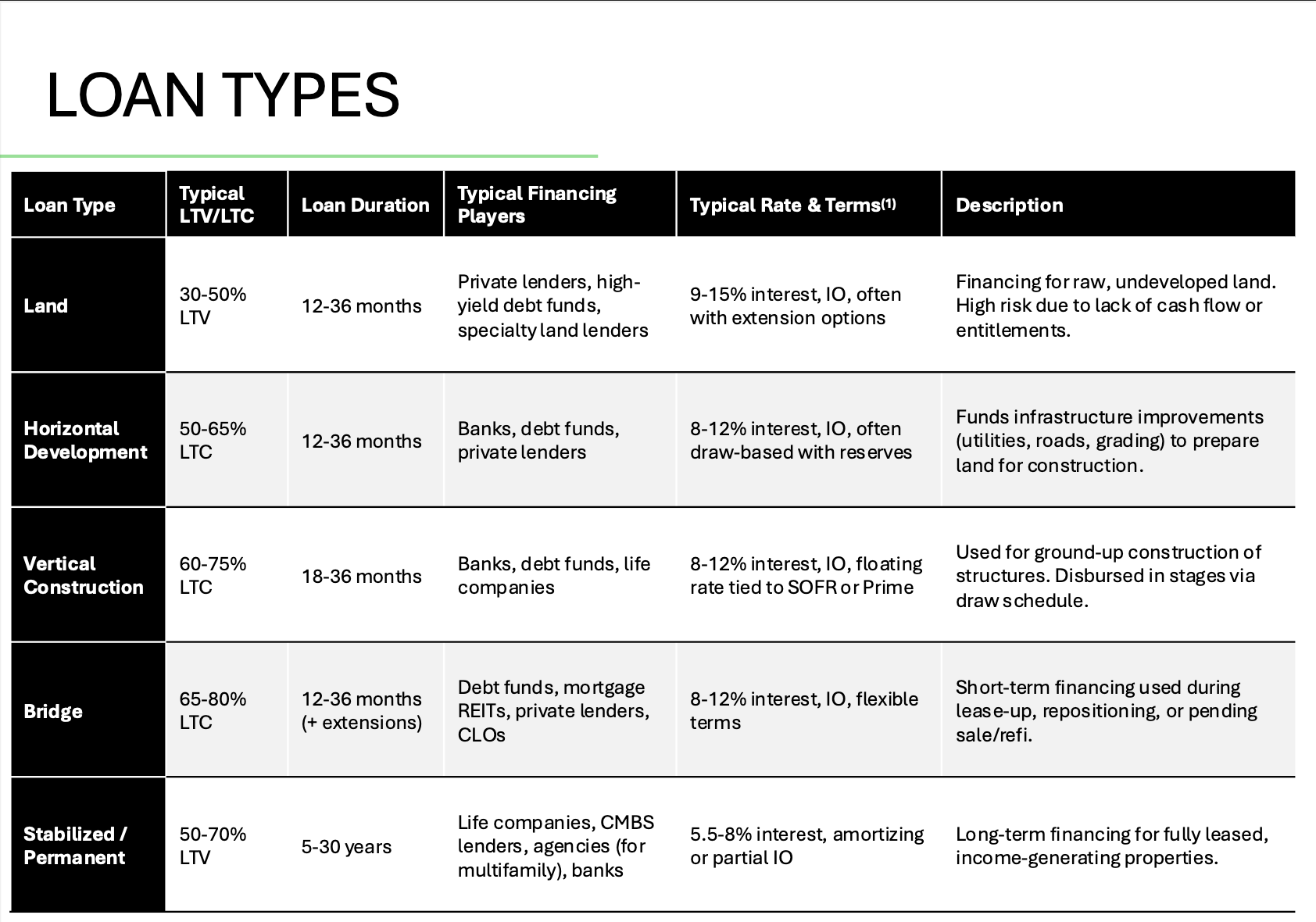

Real Estate Loan Types: A Quick Guide

When it comes to real estate financing, choosing the right loan type can make or break a project. Here's a breakdown of the most common loan types used in real estate development, along with their typical terms and uses:

Land Loans

These loans, with 30–50% loan-to-value (LTV), are ideal for raw, undeveloped land. They usually span 12–36 months and come with higher interest rates (9–15%), interest-only (IO) terms, and extension options. Because they lack cash flow or entitlements, land loans carry high risk and are typically offered by private lenders or specialty land funds.

Horizontal Development Loans

Used for preparing land with infrastructure (like utilities and roads), these loans typically have 50–65% loan-to-cost (LTC) ratios and 12–36 month durations. Interest rates range from 8–12%, often with IO terms and draw-based structures. Banks, debt funds, and private lenders are common financing sources.

Vertical Construction Loans

For the actual construction of buildings, vertical construction loans come with 60–75% LTC ratios and 18–36 month terms. Rates are similar (8–12%) but usually tied to floating benchmarks like SOFR or Prime. These loans are typically disbursed in stages and financed by banks, debt funds, and life insurance companies.

Bridge Loans

Bridge loans serve short-term needs such as repositioning or refinancing. With 65–80% LTC and 12–36 month terms (plus possible extensions), these loans are flexible and often interest-only. They’re offered by a wide range of players, including debt funds, REITs, private lenders, and CLOs.

Stabilized/Permanent Loans

Designed for fully leased, income-producing properties, these loans have longer terms (5–30 years) and lower interest rates (5.5–8%). They usually amortize fully or partially and are offered by life insurance companies, CMBS lenders, and banks.

(1) estimated as of 4.7.25